Under section 11 of the Maharashtra Ownership Flat Act (download MOFA), the builder/ Developer/ Landowner/ promoter are duty bound to co-operate with the CHS and execute a Conveyance deed before the Sub-Registrar and the original documents are handed over the new owners after completing all the necessary procedure.

The builder/ land owner and/ or their legal heirs may not co-operate as they foresee a future commercial value of the property including usage of potential FSI for their personal benefit. The society then has to appear before the Designated Competent Authority to get Deemed Conveyance. Deemed Conveyance is the final Conveyance, which can be registered. Only this will give legal ownership and possession rights to the society.

The papers required for doing Deemed Conveyance:

Stage 1 – Submission of the following documents to the District Deputy Registrar, Co-operative Societies, affixing a court fee stamp of Rs 2,000 on the application:

- Application Form 7

- Draft of conveyance

- True copy of the Society Registration Certificate

- Copy of resolution passed in Annual General Meeting or Special Body Meeting

- Property Card extract, which provides the evidence of the ownership of the property. You can find details of your property card online, for Mumbai City and for Mumbai suburbs. You will need to input your CTS number. For rural land, this document is called 7/12.

- List of members in prescribed format

- Copy of the legal notice and Public notice in 2 newspapers, of which one shall be in Marathi, issued to the original owner or developer for doing conveyance, including details of correspondence address, telephone number etc. of the original owner or developer

- Construction Commencement (CC) and Occupation Certificate (OC). If not available, then an undertaking in prescribed format.

- Copy of last sale agreement and Index-II for each member as issued by the Sub-Registrar of Assurance

- Copy of the Development Agreement between land owner and builder

Stage 2 – If Builder has submitted a reply, then a formal hearing is held. If there is no response to the notice, then review of the details of Stamp duty paid and registered agreement copies of all individual flats/ shops. Hearing, Adjudication and Passing of Order is by Joint District Registrar and Collector of Stamps. There is no appeal against the Deemed Conveyance order passed by the competent Authority. Then draft deemed conveyance must be registered at the Sub-Registrar’s office.

Like regular Conveyance, even on Deemed Conveyance, the stamp duty will be only Rs.100/-, if all the flat owners have paid the stamp duty and registration of their respective flats on the last transaction for each flat. In case there are some flat owners who have not paid the stamp duty or have escaped the duty, the same will have to be paid after obtaining the deemed conveyance, at the time of registration of the Deemed Conveyance deed by the legal bodies and the same can be recovered from such flat owners.

Stage 3 – To apply for society’s name in property card or 7/12 to the City Survey Officer or Circle Officer/ Talati. If society did not have an OC while applying for deemed conveyance, it is compulsory for the society to obtain an OC from local Municipal authority , after the deemed conveyance is obtained.

Documents to be obtained from City Survey Office:

- City (CTS) Survey plan

- Property Registration Card or

- 7/12 extract of the land

- Village form 6 (Mutation entries from Revenue Office)

Documents to be obtained from the Collector’s Office:

Documents to be obtained from the Collector’s Office:

- Copy of the Non-Agricultural Order

- Certificate of the exclusion from Land Ceiling Act (ULC) Certificate

Documents to be obtained from the concerned Municipal Authority Office:

- Copy of the approved plan

- IOD

- Commencement Certificate

- Building Completion certificate

- Occupation Certificate (not compulsory)

- Property taxes paid

- Location plan of the building

Documents to be obtained from other professionals:

- Search Report of the land issued by the Solicitor/Advocate

- Title Certificate of the Property issued by the Solicitor/Advocate (Search by minimum for last 30 years)

- Land Measurement Map/ Architect’s Certificate (layout plan of the plot)

- Certified copy from Panel Architect about the utilization of full FSI or FSI if any left in respect of the said property /Plot.

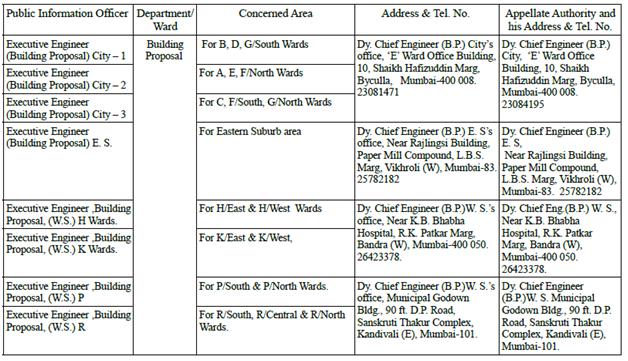

If you wish to file an RTI, to get your original building documents, here are the addresses and contact numbers of the BMC departments:

Please don’t use this write-up as a replacement for legal opinion. For more information, please consult a competent advocate.